What Is Money? Why Pay Taxes?

Money is created digitally, out of thin air. How can this be? When the federal government spends, it just deposits digits into an account. The government doesn’t go to Fort Knox to find the money, it simply changes the digits.

When we pay taxes, the opposite takes place. The government destroys the digits, takes money out of the economy. It doesn’t have to wait for the money to show up first, it simply changes the digits.

Once, for every dollar, there was a given amount of gold held in a vault in Fort Knox or wherever else the central banks held their gold. This limited the amount of money moving through the economy, because you had to have the gold in the vault before you could create the dollar. It put constraints on the central bank and the federal government.

Long after other governments around the world stopped the practice, the United States continued to give foreign central bankers gold for dollars, at the rate of about $35 an ounce in the 1960s. In 1971 Richard Nixon shut the gold window because we had too many foreign investors exchanging their dollars for our gold, and not enough gold.

We adopted a fiat currency, the value of which does not depend on an objective commodity (like gold or anything else). Effectively, money could then be created out of thin air.

Nowadays, we hardly even see our money. We can’t see it, feel it, or smell it like we once could. We no longer experience money as a physical reality like we did when it was backed by solid gold. Now, it is digits.

There is much misunderstanding, even among our leaders in Congress, about what money is. The people who really understand are the central bankers. What money is, and how it is created and destroyed, should be more widely understood.

Who can create money out of thin air? Banks and governments. Banks create money when they make a loan. The bank simply makes a deposit into your account, changing the digits, and the money is created. How can they do that? They can because money is no longer backed by anything; it is simply digits. For banks, money is destroyed when somebody pays back the loan.

Governments create money by spending. That’s it. To fund Mr. Smith’s yearly Social Security cost-of-living increases, for example, the government changes the digits going into his account. The government does not need to bring in the money through taxes to have enough to fund itself.

When I first understood this, I was shocked by it. We’re so used to looking at the federal government like it’s a household. It is not a household and does not operate like one.

Households, state and local governments, and corporations cannot create money out of thin air. They clearly must make money before they can spend it. I can’t go out and just spend money unless I first bring it in. None of us can. But the federal government can.

Why? Because the government has a monopoly on issuing currency. And it demands that we pay our taxes in U.S. dollars, its own currency. We cannot pay our income tax with a different currency or with some type of commodity or cryptocurrency. We pay our taxes in U.S. dollars.

There is so much worry in today’s world based on a basic misunderstanding of where our government’s money comes from. Since our currency is no longer backed by anything, not by gold or anything else, it is money because the government says it is.

Photograph by Frances D. Stevens.

What gives money its value if it is just digits created out of thin air? The value is based on the fact that we can convert our dollars quickly into something that has value to us, like food, education, housing, travel. The arrangement is built entirely on trust.

Capacity & Constraint

In the short-term, there is only so much output we can create. You don’t want too much money chasing a limited supply of output. Too much money chasing too few goods causes a rise in prices — inflation.

Therefore, responsible leaders do not print money willy-nilly. They have constraints. They have a responsibility not to create too much money. A nation’s wealth is really based solely on its output — its ability to produce things like goods, services, education, charity.

Taxes take money out of the system. So why collect them? This gets back to the inflation issue. Too much money in circulation causes inflation. The central bank understands this very well, but it does not do a good enough job explaining it to the general public.

Representative Paul Ryan is in favor of privatizing Social Security and has worried publicly that the government will not take in enough money to keep the system solvent. Before he was the speaker of the house, as a representative from Wisconsin, he asked then-Fed Chairman Alan Greenspan whether privatization would ensure Social Security's solvency. Greenspan replied that there is nothing insecure about the pay-as-you-go system, because there is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody.

The federal government has to balance its accounting books, so if it spends more in a given year than it takes in in taxes, it can issue government bonds (run a deficit), which are purchased by households, businesses, and other governments as a form of savings. Or, the central bank (Federal Reserve) can purchase the bonds.

When the federal government lowers taxes, that means they’re taking less money away from households and businesses, allowing them more money to save, buy bonds, spend it and, if they're businesses, invest in productive assets.

This doesn’t mean the government can spend as much money as it wants. Its capacity is the private sector’s ability to produce goods and services. If the government just spends and spends and spends, and capacity gets constrained, it will lead to rising prices — inflation again. This will require businesses to pay higher wages and spend more.

So the first reason we pay taxes is to prevent inflation.

Another reason we pay taxes is to contribute to the democratic process. We’re part of a country, a democracy. The government has other ways to balance its accounting books, but by paying taxes we do our part to contribute to the democratic process.

The New Tax Bill

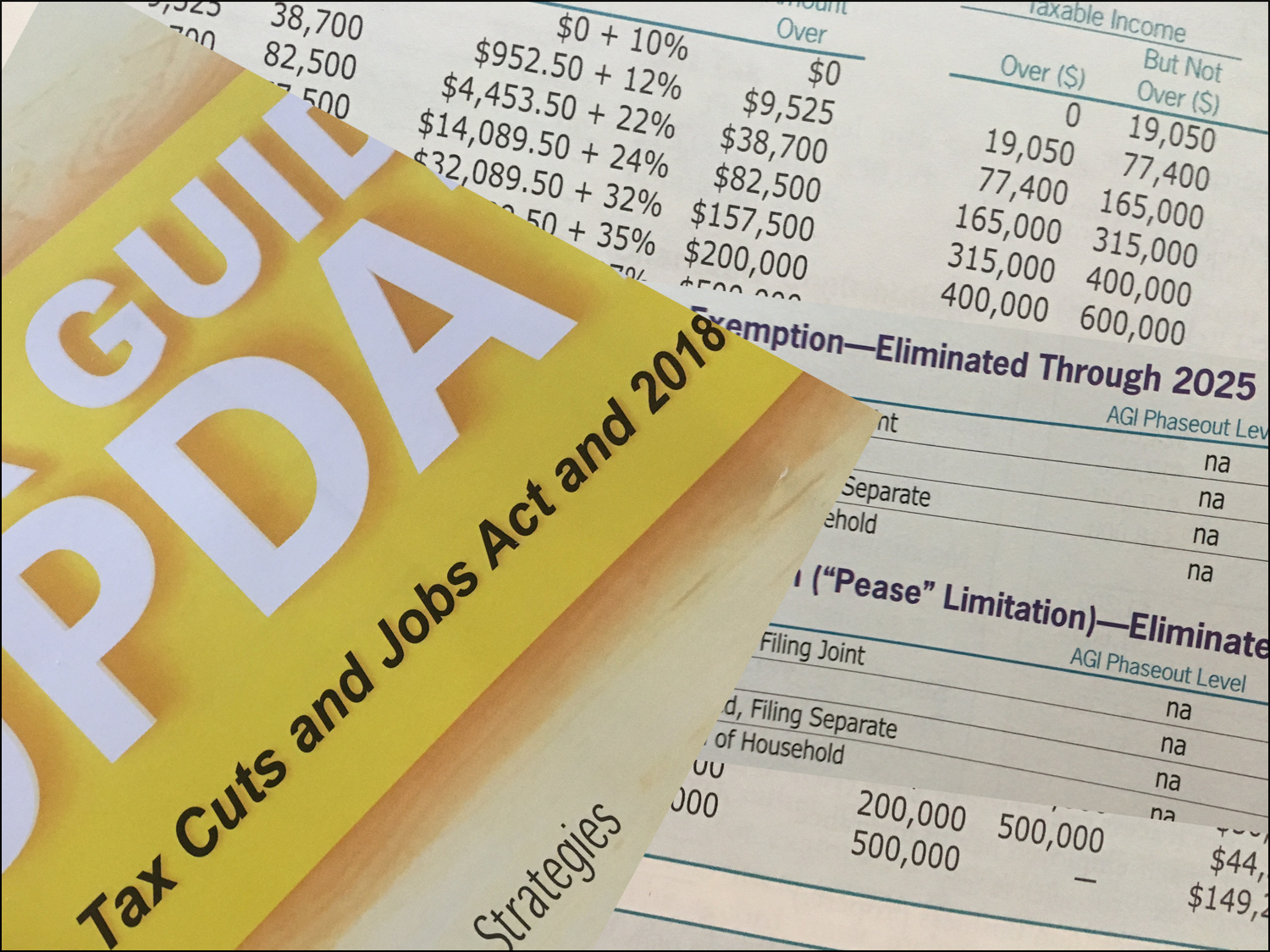

As the work on the Tax Cut and Jobs Act of 2017 made clear, taxation can be highly political. The Tax Reform Act of 1986 was a bipartisan effort, with a Democratic majority in Congress and a Republican majority in the Senate.

Politics has changed since 1986. The recently enacted tax law was not at all a bipartisan effort. Republicans wanted to simplify the Internal Revenue Code, and they did that by creating higher standard deductions and eliminating certain deductions, which will mean fewer required forms to file. Many people will be filing less complicated returns in 2018.

This is good, in a way, but not for everyone. The loss of the mortgage interest deduction is actually bad for the housing industry, because there is no incentive for people to take out mortgages. There will be no difference, from a tax point of view, between owning and renting.

Charities may suffer. Since the new law takes away most people’s need to itemize deductions, there will be less incentive to give to charity. This is a real worry to nonprofit organizations.

People living in states with high state, local, and real estate taxes (California, New Jersey, New York) are subject to the same deduction limits as people who live in low- and no-tax states. High-tax states are trying to work their way around these limits, hiring experts to see how they can categorize state income taxes to make them deductible. We’ll see whether any succeed.

The Tax Policy Center and the Joint Committee on Taxation, both nonpartisan think tanks, agree that by 2018 the average household will have its taxes reduced by $1600. But it really depends on how much you make.

If you make under $25,000, your tax cut will be about $60. If you make between $49,000 and $86,000 (middle quintile), you should see a cut of about $900. If you’re in the 95th to 99th percentile ($308,000 to $733,000), you cut will be about $13,500. The one-percenters over that will see a tax cut, on average, of $51,000.

The thing to consider is that those with the most income pay the most overall taxes. Some reports say the new law increases tax inequality. But it doesn’t. People making more than $100,000, 20 percent of all taxpayers, pay 78.7 percent of all income taxes in the United States. People making over $1 million pay 19.3 percent of all taxes.

Under the new tax law, households making over $100,000 will collectively pay more as a percentage, 79.1 percent (up from 78.7) of all taxes paid. Those making over one million dollars will collectively pay19.8 percent (up from 19.3). Those making more will get a higher dollar decrease, but they will still be paying most of the nation’s taxes.

What is the impact of this on the economy? Both the Tax Policy Center and the Joint Committee on Taxation expect the economy to grow, the amount produced in terms of goods and services to increase.

Lower tax bills means more income in our pockets, which means more spending, which will increase demand, which will cause businesses to create more output. Gross domestic product (GDP) — the dollar value of goods and services produced in the economy — will increase because there will be more demand.

Their second expectation is an increase in workers. A lower tax rate may provide an incentive for people who have stopped working to get back into the work force. Third, businesses may have more incentive to invest in capital projects that will increase productivity, which will lead to greater output.

The Tax Policy Center estimates that GDP will grow about 0.8 percent faster in 2018, the Joint Committee estimates a 0.7 percent faster growth.

The new tax law also provides for less tax revenue for the U.S. government. The deficit will get bigger if the federal government continues its present spending or increases it.

The Tax Center and Joint Committee estimate that between 2018 and 2027 the federal budget deficit could increase from between $1.1 and $1.3 trillion. The government will have to balance its accounting books by issuing more debt, hopefully to be bought by households and businesses. The deficit and the economy will both grow.

Much Is Up to Corporations

Businesses have an opportunity to change their behavior with the corporate tax cut. The one-time repatriation rate of 15 percent for cash and 10 percent for other assets could bring back $2.6 trillion to our shores.

Will businesses bring back their money? Will that strengthen the U.S. dollar?

The new tax law gives businesses an incentive to invest. In their book Capitalism Without Capital, Jonathan Haskel and Stian Westlake quote the U.N. System of National Accounts (SNA), which gives this definition of an investment:

Investment is what happens when a producer either acquires a fixed asset or spends resources (money, effort, raw materials) to improve it. (see References, p.20)

What the authors mean here by "asset" is an economic resource that is expected to provide benefits over time, a fixed asset that results in using up resources in the process of its production. A plane, a car, a factory, or something intangible like a drug patent are all examples of such an asset. They do not mean an asset in the personal financial sense, like owning shares in a company. Instead, it is something physical and tangible that has been produced.

Before, companies couldn’t reduce their taxable income by expensing such assets in the year acquired. Under the new tax code, they can expense (depreciate) all of their assets through 2022. So the new tax law gives businesses an incentive to invest in new projects.

They have real choices. They can invest in the economy, or they can continue to increase income inequality by using their higher after-tax income to pay shareholders more dividends or buy back stock, which they have done much of over the years.

They could do other things. They could lower prices, which would be a real benefit to their customers. They could help reduce income inequality by using their increased funds to pay their employees higher wages. Fifth Third Bank in Cincinnati, Ohio, my wife’s former employer, has recently announced such a plan. They could invest in new capital projects in the United States.

We have no idea what they will do. But the new lower corporate tax rate does give both overseas businesses and U.S. businesses a greater incentive to invest and remain in the United States.

Overall, this new law could create more jobs and the economy could grow faster, depending on what businesses do, and depending on the ability of corporations, households, and the federal government not to create constraints for the central bank.

The risk is that increased investments by businesses, a greater demand for products and services because of greater household income, the inability to maintain production fast enough to meet demand, and a larger budget deficit by the federal government will all cause capacity to be constrained. Inflation could pick up and interest rates could rise.

There could be unintended consequences of this tax reform. We do not know how it will turn out. It will reduce and simplify taxes for most of us, which is good. But it does change incentives and always involves politics and the discussion of what is fair.

Related to this, in 2010 Congress passed the Pay-as-You-Go Act (PAYGO), which requires the Office of Budget and Management to order automatic spending cuts if legislation is passed — such as this tax reform act — that causes an increase in the deficit.

Unless Congress waives the rules, that is potentially $136 billion of cuts in 2018. So there are technicalities that still need to be worked out. Will Congress waive the rules to allow the potential benefits of the tax cuts, such as more income to households, a faster growing economy, and more income for businesses (to be given largely to their workers, one hopes, and not used to buy back stocks or increase their dividends)?

We must simply wait and see what the consequences are down the road, both intended and unintended.

Works Cited

Jonathan Haskel & Stian Westlake, Capitalism Without Capital: The Rise of the Intangible Economy (Princeton University Press, 2018).

Comments? Please send your responses

on the site's Contact page.Thank you!