House of Cards: The Big Investors Understand You

My grandfather made bricks.

My father made bricks.

I make bricks, too!

But where is my house?

— The old brick-maker in Federico Fellini’s film, Amarcord

A house is not a home. Except when it is. Even when it’s not, owning one provides something to depend on for the long run.

A house, a home, and something for the long run are what the young couple wanted when, child in tow, they offered the asking price on a house they liked on Jo Ann Drive in Spring Hill, Tennessee, the Nashville area where the husband’s new job was.

Little did they know that the snake was in the grass on the lawn, that American Homes 4 Rent (AH4R), based in Agoura Hills, California, offered the seller the same amount (not more), but for all cash and no inspection. The offer was too good to pass up, and the firm scored another touchdown — signed the contract 12 hours after the house went on the market, as reported by the Wall Street Journal on July 21, 2017.

The dream of home ownership is alive and well in America, if you’re one of the REITs (real estate investment trusts), hedge funds, or private equity firms snatching up houses on the cheap from the housing bust and foreclosure wreakage. But if you’re just looking to buy a home in your price range that you can live in, then depending on where you’re looking, ownership may be out of reach. Not because you can't afford it, but because you’ve been targeted as a renter.

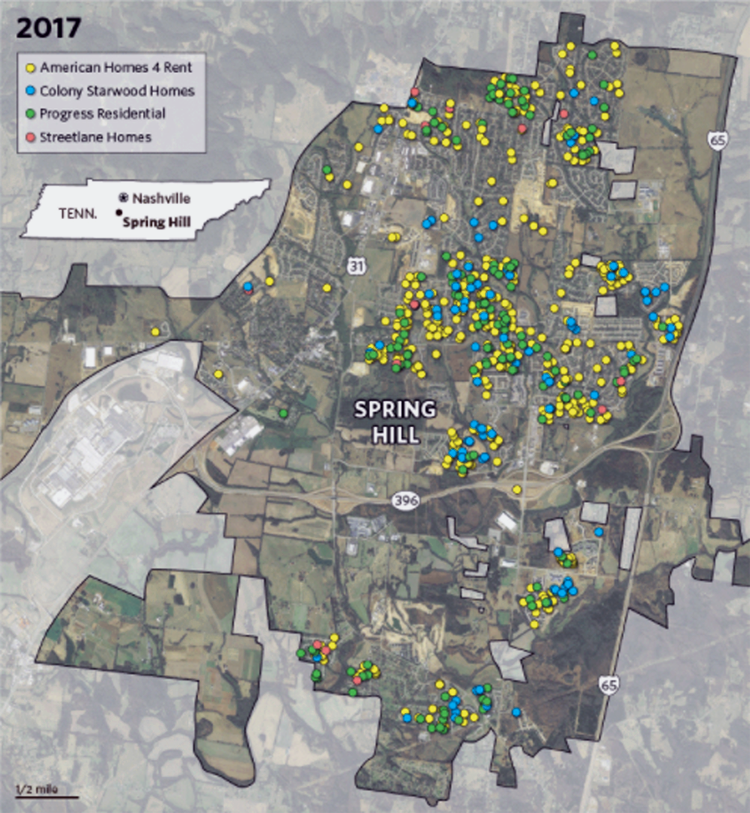

In the Spring Hill neighborhood alone, four single family rental firms own more than 700 houses. American has reported that as of June 2017 they owned 48,982 single-family houses in their selected areas in 22 states (see their online profile).

Another couple moving to Spring Hill to start a new job planned to use the profit they made selling their house in California to buy a new one, only to find that they could not pass Go even after making continuous, multiple bids above the asking prices. They settled in, unhappily, as tenants of Colony Starwood (now Starwood Waypoint).

The big investors feel that they understand you, especially if you're young. Scott Crowe, chief investment strategist for CenterSquare, a real asset investing firm, says that millennials are starting to move to the suburbs and have families, but “they don’t believe owning is a path to the middle class, there’s a larger propensity to rent” (see A. Riquier, New Real Estate Sector).

How does he know what they believe?

What is his recommendation for a path to the middle class?

The investor-landlords enjoy believing that millennials don't consider home ownership a core expectation and don't necessarily see a house as the best place to store some equity, that they really don’t mind renting, in fact they want to, as long as they can raise their children in a community with decent schools, houses, and jobs.

With this self-comforting understanding of millennial psychology, the new landlords don't have to get complicated. They find locations that attract jobs and offer affordable homes, and then buy up all the properties for sale. Then you can rent and leave the maintenance to them! American Homes’s website states that they aim to manage “with a local touch.” It sounds almost cozy.

But your interaction with them will only be online. There is no landlord nearby, no handyman to call directly, no friendly face hearing you out over a cup of coffee.

Because it is a national company, communications … are problematic. … We had to fight multiple people through the chain of command to get [both] simple and major repairs done, all of which were present when we moved in. This took a year to get resolved. — American Homes tenant

The back sliding door would not lock, the dish disposal fell out of the kitchen sink, the refrigerator ice-maker broke, the sprinkler system broke, the house flooded during [Hurricane] Matthew. We paid for all of it including hurricane cleanup. They fined us when the lawn turned brown from lack of water, although we paid them for pool service we had to service the pool ourselves. — American Homes tenant

The single family home ownership rate in the United States is hovering around 50-year lows. This fact has its precedence not only in our recent housing crisis, its causes reach back through decades of stagnant wages, the movement of manufacturing jobs overseas, and certain technological disruptions, all of which occurred with little to no response from the government or the private sector.

Instead of addressing the problem, big investors are exploiting it. They're giving it an upbeat spin based on logic and greed. The spin is this: today's falling single family home ownership rate indicates that more and more people prefer to rent.

If repeated often enough, the spin will be believed — because that’s what happens when you repeat something over and over. You start believing it. A new source of investment income has appeared on the American landscape, and this is it!! For the investors, the American dream is alive and well.

Three-bedroom homes in Spring Hill that only a couple of years ago rented for $1000 per month are now pushing $1800. The Journal’s analysis of the companies’ own records “found the posted rents on … homes averaged 32 percent more than the monthly ownership cost.”

The worst part, I think, is that they raise the rent every year. Our rent went from $1875 to $$2300 in two years. If you read the fine print, they will tell you your original rent is an introductory rate. —American Homes tenant

Lords & Tenants

In the later 1600s and into the 1800s, New York State’s Hudson River Valley mansions were supported by tenant workers — farmers and machinists who came mostly from the German Palatine. The ruling families who owned the houses, original Dutch business settlers and royal appointees of George III and their descendants (Beekmans, Livingstons, Astors, and Roosevelts among them), were usually related by blood and marriage, and the homes were connected to one another by allées (long passageways), so the inhabitants need only ever see each other, unencumbered by the outside world. They treated their tenants decently enough, I suppose, they just owned everything in sight.

The tenants lived their entire lives on the land they worked. Driving through upper Dutchess and Columbia counties, you can still find ruins of tenant cottages, but there are few now because of the remarkable cultural renewal that Hudson Valley communities have been experiencing for the last 20-plus years. Artists, buinesses, lovely young weekend farmers from Brooklyn, and an industrious population whose roots go back to the old tenancies have remade the area into a destination.

The mansions are still there, some open to visitors, some privately owned, and a few are still lived in by original family descendants. Before they were re-discovered as historically significant, they were relatively inexpensive for great houses. You might even know someone who lives in one.

My husband and I have toured the historic homes, read the quirky, interesting histories of the ruling families, trekked the old railway tracks and allées, and picked our own fruits in the orchards. Now we go there to do nothing; it’s a restful area for all of its renewal. I love walking around Barrytown, the only Barrytown in the United States, population 200, home to former American aristocrats. Oh, you won’t find a tenant farmer there now. It’s charming, a bit eccentric, with an enduring scent of history.

But I’m from Pennsylvania — Philadelphia, and then Lancaster, where the oldest homes still standing are early 1700s log and stone cabins of self-supporting people who had the fire of freedom in their blood. I was shocked when I first learned years ago that the upstate New York manor houses had been supported by people who were tied to them by tradition and debt.

Why is this word, serfdom, in my brain? It hops around up there when I read about people whose only option is to rent, even when they want to buy, simply because of who they are and where they live. The new lords of the manor are these various firms swooping up homes by the tens of thousands, competing with young people who have no line of defense against them.

Is this what they want for their own millennial children?

REITs earn their profit from the rental income they charge. They traditionally have owned or managed commercial and office real estate and large apartment buildings in urban centers where people by definition have chosen to rent. But REITs face some headwinds right now. People don’t shop at malls like they used to, they shop online. Hotels have Airbnb competition. There’s too much office space.

David Corak of equity research for FBR investment bank in Arlington, Virginia, said that the single family home rentals provide “a kind-of ... opposite” situation (see Market Watch ) vis-à-vis these headwinds. This single family rental opportunity has appeared at just the right time.

The new lords of the manor say that by gobbling up houses, they're helping to maintain stable communities. Places to safely raise children. But it's ownership that makes people care about their towns, their streets, schools, job commutes, and property values, and the landlords know it. If they're taking advantage of the foreclosure crisis, why not just market it that way and leave it at that? There's something sleazy about putting a logical spin on it, something fraudulent about marketing themselves as community builders.

The Journal report noted that American Homes CEO David Singelyn told investors at a meeting in New York City that the average household income declared by those applying to rent from the company had risen to $91,000, from $86,000 a year earlier. He said:

“Their wherewithal to pay rent today as well pay rent in the future, with increases, is sufficient. ... It’s just up to us to educate tenants on a new way, that there will be annual rent increases. This has been a very passively managed industry for 30, 40 years up until institutional players came in."

Home ownership is not for everyone. It never was. But young people maturing into job, parental, and civic responsibilities will naturally start looking for ways to control their situations and create stability in their lives. This is normal. Buying and taking care of a house (or condo or co-op) still retains an inviolable American imprimatur. It says you have made a commitment and you expect it to work in your favor. It's not an investment gamble.

What about the renter? Not to sound dramatic, but since we’re talking dreams as well as facts, the scenario presented is that of a young family paying rent for a typical mortgage period, anywhere from 7 to 20-plus years, and having nothing at the end of it. All of the payments they might have made on a mortgage, which would have guaranteed them something at the end instead of nothing, have gone to further enrich someone else. Prime earning years, the fruits of which you keep nothing. Serfdom.

The single family home rental business was once the purview of small or local owner-investors who might even live next door or down the street from their renters. Such an owner cares about his property’s condition and upkeep. His tenant knows where to find him in the event a pipe bursts.

While it sounds like quite a commitment that hedge funds and private equity have spent some $40 billion buying and renovating about 200,000 houses and have even built rental management businesses, according to Greenstreet Advisors, it’s also true that as soon as they smell trouble, they'll want out. They'll focus on an exit strategy, certainly not negotiations with tenants.

Image accompanying July 21, 2017 Wall Street Journal article. The

Journal notes that its sources are the Williamson & Maury County

property records, securities filings, and the companies themselves.

Oh, the Places You’ll Go!

Where are the new lords setting up their manors? Mostly in the Sun Belt, from California to Florida. OwnAmerica, for example, lists properties in northeast Florida available to firms specializing in single family rentals. The towns include Live Oak, High Springs, Gainsville, Jacksonville, San Mateo, Lake City, Hastings, Green Cove Springs, Palatka, and Hawthorne.

OwnAmerica provides charts showing that 2017 home prices in these towns have averaged $220,000, that their population is increasing, home appreciation rates are higher than both the state and national rates, the unemployment rate has dropped dramatically since 2011, and job growth and job diversity are strong. The pitch to investors includes this statement:

Investor protected on title. Easy access to property through eviction if necessary and probable profit 50%. Very little if any maintenance. If owner executes the option then probable 25% profit. Contracts up in 2020-2024. Sit back and collect rent on a hassle free property until then as the "tenants" are vested and maintain properties well!

I wonder what the pitch to renters sounds like.

The new Reven Housing REIT based in La Jolla, California “is looking to acquire portfolios of tenant occupied single family houses throughout the US in … all cash … transactions to sellers,” ruining a family’s chance to purchase even if it qualifies for a mortgage, because it can't meet the all-cash requirement.

Reven's target areas include Phoenix, Tucson, Birmingham, Denver, Fort Lauderdale, Jacksonville, Miami, Orlando, Tampa, Atlanta, Chicago, Indianapolis, Louisville, Las Vegas, Charlotte, Raleigh, Virginia Beach, Oklahoma City, Tulsa, Memphis, Nashville, Dallas, Forth Worth-Arlington, Houston, Irving, San Antonio, Salt Lake City, and central California.

The real estate investing firm homeunion has put out a report for its investors that ranks the top ten "opportunity cities," based on capitalization rates (rates of return on income the properties generate), entry prices, low competition, and job growth. Starting with No.1, homeunion's top ten are Atlanta, Orlando, Seattle, Las Vegas, Chicago, San Diego, Oakland, Detroit, Dallas-Fort Worth, and Memphis.

The geographic swathe in which these cities are located was the most hard hit in the housing crisis of 2008; it suffered the most foreclosures and price instability. Many of the homes are on their second round of abuse, some not fully recovered from the initial shock — abandoned and foreclosed, then bought en masse, sight unseen, quickly renovated, and marketed to people the owners will never meet and don't care to.

By the time the problems created by the bust have been fully worked through, an astonishing estimated 7.5 million households will have lost their homes. For context, there were close to 55 million homeowners with mortgages at the peak prior to the Great Recession. Nearly all of these households have since become renters.

— Moody's Analytics, June 2015

The new lords of the manor have been snapping up fewer homes in more expensive areas of the country, but they're making inroads in these areas, with the intention of either renting the houses out or selling them — "flipping" them — for more than they were originally put on the market. A couple in Somerville, New Jersey who wanted to move to a newer home that was less work than their century-old house were "put off by the ferocity of the competition" (see WSJ, 10/29/17; italics mine) — investors were quickly buying available homes and pushing up prices. The couple decided to stay put.

“This is supposed to be an economic recovery, where people are supposed to [trade up] their homes. And we haven’t seen that.”

— Sanjiv Das of Caliber Home Loans Inc. (see WSJ.)

The track record for the new single family home rental businesses is still being established. Business may be good for a while, especially if mortgage rules become more rigorous, or if the job market continues to grow in patches nationwide, but do not believe the lords of the manor have set their sights on the long term.

When you talk business, you're talking money, and you're talking people. Whether it's real to you or not, there are human beings with all their own needs, desires, and experiences at the other end of the table.

It's not helpful to ignore this. Some of the tenants whose situation is being exploited have already shouldered their fair share of bad luck. I just wonder if we're perpetuating the bad luck of people who have had enough of it. Is anyone thinking about this? Some of the homes being bought out have existing tenants. What happens to them on the sale of the property? They get thrown out with the old countertop, renovations proceed, and the rent goes up.

What if the economy gets stronger? Tenants could opt out and buy their own house somewhere else. What if prices rebound and rise above pre-recession levels? Houses slated as desirable rental income producers will get too expensive — the rents won't support the new price levels. The lords of the manor will have to become sellers to meet their own profit expectations. Who will be the buyers?

[E]xperts are backing off earlier projections that the market would settle into a sustainable equilibrium at some point this year [2017]. —Samantha Sharf, Forbes Magazine, on

2017 housing expectations

What if all the homes that can get bought up do get bought up? If the houses fitting the prescribed formulas dry up, will the REITs, hedge funds, and private equity firms start building entire communities from scratch? They're discussing it, but nothing is for the long term when dollar signs fill the highways. Besides, it's complicated. You can't simply build houses. You need all the rest — schools, houses of worship, shopping and business districts, the civic committment of home owners (who in this case would be absent). And besides, property values are unstable where there are too many single family rentals.

The Urban Conservancy.

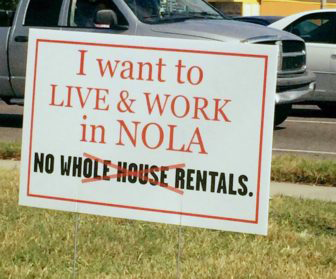

After years of discussing its Airbnb problem, New Orleans's City Planning Commission decided in August 2016 to rule that short-term single family home rentals were illegal. Too many absentee owners were allowing renters to come and go year-round. Short-term rentals accounted for three-fourths of the more than 5,000 listings in the city.

Although the new landlords aren't running Airbnb's, the problems named by New Orleans's Planning Commission succinctly describe the problems cities say they face when there are too many single family rentals in residential neighborhoods: they disrupt an area's normal housing industry, they diminish neighborhood and cultural identity, they potentially negatively affect residential representation at the polls. They create concerns about the basis of community and civic life. They negatively affect a family's ability to sell its own home because the neighborhood is filled with absentee landlords.

BIG BIG BIG

The comings and goings of single family home purveyors can seem incestuous. They merge, change names, sell off parts of themselves, consolidate other parts, change names again, merge again, and change names again, not slowly by any means, but with alacrity.

In 2012, Colony American Homes began its single family home rental unit, and over the next three years it became a trend setter in the business. In 2016, it merged with another REIT, Starwood Waypoint, to form Colony Starwood. Thomas J. Barrack, Jr., Colony's CEO, said at the time that the deal "really crystallizes the long-term durability of the single-family rental industry."

This was Mr. Barrack's way of saying that he felt that the dream of home ownership for a majority of Americans was far off enough, will stay dead long enough, for some serious profit making. By June 2015, Starwood Waypoint and other institutional investors owned roughly 200,000 rental homes (see WSJ report, 9/21/15).

By July 2017, Colony Capital, the private equity group holding Colony's ownership stake, had sold its entire stake and Colony Starwood rebranded itself as Starwood Waypoint Homes. This situation turned out to present quite an opportunity. Barry Sternlicht, Starwood Capital's CEO, merged Starwood Waypoint with the Blackstone Group's Invitation Homes to create the biggest single family home rental company in the United States. In this CNBC video, Mr. Sternlicht describes the opportunity as "compelling."

Compelling in investor-speak means something that looks really really cheap with the promise of really really big, oversize, returns. Compelling for Sternlicht means "65 percent gross margins" and a "$60 million in synergies" for the companies. Mr. Sternlicht noted:

"There's a lot of technology being deployed in this space and we don't actually even have to go to the house to let the tenant in. He just, he's in through the lockbox and then we know when he leaves. And they send all their repairs electronically and schedule our maintenance people to go out ... just like an Uber delivery. It's become quite a fascinating business."

I guess it depends on your idea of fascinating. I guess it depends on whether you're the owner, or the tenant who doesn't really know who the owner is and is having difficulty getting through to the company online in an emergency.

According to Moody's Analytics and Harvard University's Joint Center for Housing Studies, single family rentals comprised 9 percent of our nation's housing stock in 2005, 13 percent in 2015, and 16 percent in 2016. Numbers are not yet published for 2017.

Blackstone, the New York based private equity and real estate firm, is a leader in global real estate of all kinds. It established Invitation Homes in Dallas in 2012 as an opportunistic venture. When asked in an interview whether he believed that millennials actually prefer to rent rather than own, Blackstone's Jon Gray said that "the scar tissue from the housing crisis, less credit availability, more urban living and declining marriage rates, all lead to a shift towards renting versus owning" (see Blackstone Blog, 10/27/16). He didn't offer a spin on catering to a new millennial psychology.

Invitation Homes is gifted in knowing what to say to whom, and how to say it. The company presents itself as a champion of community-building, helping the American recovery, almost as though it had a charitable inclination. It sees small (mom & pop) landlords as not really up to the job of rebuilding America (what?); only large-scale institutional landlords will be able to bring scores of our decrepit neighborhoods back to life. It's a nice narrative, presented with conviction, and the pre-rental renovations do provide some jobs.

In this "helping" vein, the Invitation people see themselves as risk takers. But the country is the one taking a risk, allowing uncertainty to gain further ground in the lives of middle class and working people. There is a reason private home ownership traditionally has been considered somewhat sacred, be that home a generational mansion, a three-bedroom house, or a condominium or cooperative — in Spokane, Nashville, or Brooklyn.

It is an established fact that most middle class personal wealth lies in people's homes. Our nation's base is becoming collectively poorer and more in thrall to all sorts of dislocating forces. People with the most money are making decisions for the rest of us as though that's their job.

It's not their job. Again, is anyone talking about this?

Invitation Homes is not a charitable organization. It aimed to fashion a brand, and it did (see its listings). Its product is uniform aross the country. Since about 25 percent of its tenants want to buy a home sometime (according to Blackstone's own research), starting in 2014 it has offered tenants in certain areas this opportunity, not wanting to disengage from a group that could provide further profits with no extra renovation requirements. The profits could extend indefinitely if the company becomes the tenant-buyers' mortgagor.

2017 Real Estate Symposium.

This single family rental business arose out of a crisis, which itself started as a response to, or rescue from, an earlier crisis. A few years after the technology bust of 2002, investors and non-investors were buying ever-appreciating real estate as a defense against earlier losses. When it got out of hand, everyone looked the other way and decided to run with it till it drops. Then when Wall Street had some real panic, no less a person than Federal Reserve Chairman Alan Greenspan said he couldn't see it coming.

The merger of Starwood Waypoint and Invitation signals that this business model is here to stay until the fields run dry. The new lords of the manor, unlike the old lords of the manor, have no integral relationship with their tenants, no mutual reliance, no tradition pitting their fates in the same direction.

The medieval serf had been almost the opposite of a property owner: the land had owned him. He could not move freely from place to place, and yet he had inalienable rights to the piece of land to which he was attached. ... While a serf could not be removed from his land, a tenant [can] be evicted not only through failure to pay the rent but merely at the whim of the landlord.

— Lewis Hyde, References, p.157

If only they did have some common interest. But they don't. So many businesses that ostensibly are American actually are global, and America comes second. In this environment, business is like water — it flows where there's an opening. And you know how water is — forceful, its own energy source, with flooding power. So we need to build a few dams. We need government for that, and we need ordinary people with good long-term vision.

Not to pick on the single family home rental business; it's just that as I kept reading about it over the last few years, a creepiness started sinking in. There's a destabilizing aspect here. For many, it's one more step toward a loss of control over their day-to-day life. If you want to buy a house in an area you're moving to for a new job, you should be the preferred buyer, not some outside entity that isn't dedicated to the civic, cultural, or employment life in the area.

It's the same feeling I get thinking about the technology companies that assume that they are the owners, keepers, protectors, whatever, of our private information (until it's stolen). Certain businesses are making decisions for us from a prerogative not our own, in areas of our lives where there is no cultural precedent for such things.

The investors scooping up houses by the neighborhood don't see it that way; they're businessmen, they see opportunity, they pounce. Business is business; when you're in it, it's what you do. You don't ponder very deeply whether you actions may lead to community fragmentation, a lessening of social feeling, or a feeling of general impermanence. You'll need a group like New Orleans's Planning Commission for that.

Here's a scenario: a couple hundred thousand young families, after paying rent for years, have no equity. Their children go from elementary school age to college age pretty quickly. What looms is the future, the expensive future, which may include sick or aging parents, predatory college loans, job uncertainty — situations for which there are no funds to deal with.

It's just not true that millennials are simply not interested in owning homes. This is a fantasy. The millennials unable to afford home are not all children of the poor and middle class. A large number of them are educated, vital. They deserve better. They are stakeholders in our country's future. We need vital stakeholders.

Reference

Lewis Hyde, The Gift — Creativity and the Artist in the Modern World (Second Vintage Books ed., 2007).

Comments? Please send your responses

on the site's Contact page.Thank you!