Greed & Fear, Inc.

The king was in his counting house

Counting all his money . . .

—From the nursery rhyme Sing a Song of Sixpence

Anyone who tries to navigate his financial life without knowing something about the circuitous routes of modern finance is harming himself. Do you know the final stop of your mortgage payment? Which high frequency trading (HFT) platform trades your pension benefit? What that costs you? Who owns your local bank? That money is a game with made-up rules? That yours is “the dumb money”?

The February 17, 2017 Wall Street Journal had a front page story about a 68-year-old professional woman from Monterey, California who “lived like she was rich” until her fortunes collapsed in the recent recession. After declaring bankruptcy, she sold her condo for less than she paid for it and moved to an affordable community in Iowa, population 700, where she is enjoying a less expensive life.

This woman was a successful realtor until the financial manipulations of her own profession bankrupted her. As far as wanting a rich lifestyle, she should have known better. But it also wasn’t all her fault. No money manager ever told her she could not afford her BMW Roadster, Lexus, condo, and couture handbags.

Once upon a time, financial abuse stories had beginnings, middles, and ends. Family affairs of the rich and famous, such as Sumner Redstone's elder abuse case, still have this tone. The 93-year-old is suing his two long-time lady companions, who colluded to fleece him of $45 million (each). The philanthropist Brooke Astor’s son Anthony Marshall, and his lawyer Francis Morrissey, were convicted in 2009 of changing her will to redirect her money to them, of forging her signature, and several other crimes. The gist of these stories is easy for a person unschooled in finance to understand.

But the financial contrivances that brought on the Great Recession and that are still in practice are not fathomable to the financially unschooled. The tricks that banks, brokers, and exchanges have felt pressured to perform, created in clouds of greed and fear with no room for conscience, have profoundly altered the personal situations of many Americans.

You can't quite locate a beginning, middle, or end (there isn't any) of the unruly financial manipulations practiced today. You can't quite map a cause and effect. They’re top-down/bottom-up events with no center of gravity and no center of responsibility.

I at first thought I would write about financial abuse of the elderly. The March 2015 issue of AARP Bulletin tells some awful stories. A pensioner's union told him that they had overpaid his pension for 20 years to the tune of $97,000 and that he had to pay it back at 7.25% interest, even though it was their mistake. They wanted $66,000 within three weeks or his pension would be slashed. A New York City transit system pensioner had his monthly benefit reduced to $5 per month (you read that right, five dollars) from $1,414, after the city's retirement system decided it had overpaid him $163,423 over 22 years. A widow who paid her property taxes in full in 2009, but six days late, had her home seized and sold to get the $6.30 late fee, which over time incurred unpaid interest of $234.72. The woman never received a bill from her county for the late fee or its accumulated interest.

After looking into my own personal IRA losses in the 2001 market meltdown, I was so frustrated with my broker’s answers that I called directly the insurance entity that handled the funds. A helpful person on the other end of the line explained to me that my loan payments were adding to the losses. Loan? What loan?

In addition to investing my money, which gave my broker an excellent commission, he inserted a loan into my account that was deemed a “credit” on my statement. When I asked what this “credit” was about, the broker said it was a "gift" the insurance company gave me as a “goodwill gesture” for entrusting them with my funds. He lied, and got an extra commission from the company for inputting the loan. When I left him and the company, my dwindled funds were used to pay off the loan.

I didn't think of myself as naïve. But I also didn’t think of my broker as a liar and a thief. He thought I'd make enough money not to notice anything, and hey, it wasn't that big a credit.

Most money managers are honorable—it's just that they're only focused on making money. I heard a well-known fund manager at one of my local AAII (American Association of Individual Investors) meetings announce that Company X was letting people go (by the thousands), which will have a positive effect on earnings. When I asked about the implications for society of so many people being left jobless, he dutifully shook his head and then quickly got back to discussing what it meant for shareholders.

We need an educated citizenry. The post-war era that Donald Trump's voters want to revive no longer exists, but the expectations it engendered are alive and strong. We've had it so good for so long, we have an automatic assumption that things are supposed to work out for us.

But we haven't matched that assumption with an insistence that we get educated in how modern finance really works and get trained in skills that will protect our ability to work and help us fight for our jobs. Many Americans don't have a basic understanding of finance, much less how money gets moved around the world. Add to that the technology gap and the globalization of our big companies, and disillusion and despondency start setting in.

It's not fair or smart to expect that everyone is on his own, that we must simply find our own way through the disruptions over the last two decades. Even the people who run global businesses and financial exchanges don't entirely understand them, so how is the ordinary trusting person supposed to find his own way through the changes? What is most troubling is that he is more likely to have his ignorance exploited than he is to be helped.

For example, there are students using their college loans to buy clothes and cars, because nobody has ever told them they cannot. No one sat them down and told them that their $20,000 loan could balloon to over $100,000 if they defer payments for too long, or that they can never dismiss their loan, even in bankruptcy, or that they will need a high enough income level to cover loan, credit card, rent, and related monthly payments once they finish school. Right now, about 44 million American students owe over $1.3 trillion in student loan debt.

In a recent letter to the Wall Street Journal, personal finance professor Daniel Schneid wrote that his course could be the only college experience where financial reality seeps in:

The first project I assigned was for students to research the expected starting salary of their chosen field, and then produce a monthly budget on how they planned to spend that income. Almost unanimously, they ignored federal, state and local taxes and FICA. When we all did this project together, the realization crept in that they couldn’t afford a new car and that condo on the beach. And there was stunned silence when they were asked about paying back student loans. (WSJ, March 29, 2017)

Image © Harry Campbell, 2009.

In 1980, Congress created a program with subprime characteristics called Parent Plus that allows parents to borrow on behalf of their college-age children for both tuition and living expenses. The program doesn't require proof of parental ability to pay back the debt. In 2011 the Obama administration tried to place certain restrictions on these loans, but the schools successfully fought the measures. Thousands of elderly people are now putting off retirement and forgoing health expenditures in order to pay off the loans.

With the recession officially over, for-profit colleges are back. Tressie McMillan Cottom, a teacher who has worked for two of them, has written a book (Lower Ed, see References) about how good these schools are at figuring out the needs of their non-academic students, many of whom are laid-off parents who are trying, in ignorance and without proper advice, to position themselves to re-enter the job market. Cottom was taught to "close" the students—sign them up—quickly, before family members could tell them to reconsider taking on more debt. Cottom was also instructed to give inaccurate data about the jobs available once the students earned their certificates (think Trump University).

Does this sound immoral to you? Or at least jugular, with students the quarry and job promise the lie? Wouldn't you want to be prepared going in? Why, in fact, would you go in?

We're a forward-looking, industrious, practical people. Fixing things is in our DNA. But we need honest information. We need openness from the government, business, financial, and tech worlds, and even more important, they need some response from us, they need our input. After all, the 99 percent are the bread and butter of the one (especially the 0.1) percent.

But who in the top hierarchies has any interest in telling the truth? Banks and financial entities are again plying risky credit, home equity, and mortgage products. In 2016, financial firms had the highest fee income from overdraft charges since the 2009 recession, totaling $33.3 billion. In an eerie replay of the recent past, subprime borrowers are the biggest payers of these fees.

The New York Stock Exchange reported that this past February, investor borrowings against their own investments climbed to more than $528 billion, the highest level in two years. Are people taking advantage of a perceived uptick in the markets since Trump's arrival, using their borrowed money to invest even more?

Or is there a less robust reason for the borrowing? U.S. credit card debt is above $1 trillion for the first time since January 2007. Historically, steep rises in such debt have augured subsequent financial collapse. We have to keep sight of the forest and the trees, the lure of rising markets against a realistic awareness of what we can personally handle.

The three major credit-reporting firms—Equifax, Experian, and TransUnion— have actually decided to encourage borrowing by omitting tax liens and civil judgments from credit scores in an effort to boost upwards of 700,000 scores by a whopping 40 points or more. Borrowers with liens or judgments are more likely to default on payments, of course, but the siren call of the short-term, fee-focused event is simply too mighty for lenders to resist.

Barclaycard, a unit of Barclays PLC, recently sold $1.6 billion of its subprime credit card accounts and balances to an online-only entity in Texas called Credit Shop, which counts Renren, the Chinese social network, as an investor.

Barclays thinks it made a smart move. But does subprimer Jane Doe, whose unreliable financial activities will be wrung out for what they're worth, have any inkling that global investors are counting on her to make them a profit? What's wrong with this picture?

Goldman Sachs went the other route, buying (through March 2017) about $4.5 billion of underwater loans from both Fannie Mae and private sellers. It plans to make lemonade of the lemons, to squeeze what it can from Jane Doe's delinquent mortgage payments. It will foreclose on her (put her on the street) if she doesn't pay up. Let the taxpayers deal with it.

The idea that a healthy economy depends on people spending money they don't have, or spending what they have instead of putting it in the bank, is untenable. The idea that the financial industry likes to keep people in the dark to keep its competitive instincts razor sharp and its addictions well fed is scary. This situation is an unpromising conundrum. Your ignorance is their bliss.

Nobody likes to be kept in the dark. Nobody likes the feeling that there's something they should know but do not, or that their financial future is out of their hands. "Transparency" was the resounding cry of the post-recession reformers, but the efforts toward transparency are dwarfed by counter-efforts for greater and greater secrecy.

The richest Americans, about 150 families, are now veering away from the large banks, Wall Street firms, hedge funds, and private equity groups, whose activities are registered with federal regulators. These families are creating private family offices, a designation that excludes them from registration requirements. They want to compete with the public firms to make acquisitions, finance startups, lend to companies, and engage in esoteric (complexly structured and priced) financial products. The private offices now control about $4 trillion of assets. (See also this recent report.)

Their activities, securely invisible, still affect our economy, our jobs, and our sense of well-being. We are a society, after all. Many of these private offices may have good intentions, along with the money to hire their own analysts to make the types of information assessment they personally value before making investment decisions. The thing is, the whole country could use this kind of attention to societal needs like jobs and education.

It sounds trite to say we're in a new gilded age, but this one is more complex than the age of Rockefeller, Carnegie, and Morgan because it's global. The Morgans, et al. gave us museums, universities, public parks, and raw cash for scientific research (e.g., see the gifts of the recently deceased David Rockefeller, grandson of the original oil titan). But we don't know where the invisible players are setting their sights.

Some have their sights set on leaving the country that made them rich—they want a no-pay-back, tax-avoidance jump into a place that whether or not it is democratic, it does deliver on the low-to-no-tax part.

In a Bloomberg Radio discussion on March 8, John Prescott, the founder of John Prescott Advisors, said that according to the U.S. Treasury, 5400 Americans expatriated in 2016. It can be tricky, he notes. If you give up U.S. citizenship you have to pay taxes on all of your assets as though you sold them all in the tax year. "You’re talking significant wealth." Then you have to get all your losses together to offset them. "You want to make sure that the assets that have yet to appreciate get out."

What should the ordinary working (laid-off, downsized, replaced) person do? Nassim Taleb has it right in his book Antifragile (see References). We should find ways to live with uncertainty, and here I'm thinking about financial uncertainty. We should work to make ourselves less fragile, more sturdy. Let some pieces fall where they may. The credit issuers may jump in to help you when you're down, but they aren't your friends in this pursuit. The goal is to be less beholden, not more.

Focus on knowing where you stand financially vis-à-vis others. Learn where to find the information you need to make that assessment. Make sure you know from the get-go the rules of any transaction you engage in. Build up non-retirement, cash savings. Live below your means. Get a saleable skill. Keep it saleable. Avoid investments you don’t understand. Learn as much about technology as possible. Know how scammers use the telephone and Internet. Take full responsibility for your actions. Nurture your family life.

Rather than love, than money, than fame, give me truth.

—Henry David Thoreau, Walden, Ch.18

The Rape of Timken Steel

The activist firm Relational Investors, never a household name, went out of business recently. Started in 1996 by Ralph Whitworth after he left his post on the Senate Judiciary Committee, it managed $6 billion of pension funds. Relational targeted companies it thought it could make lots of money on and then bought enough shares to descend on them and demand changes. Like other activists, it fought for board seats, browbeat CEOs, advocated splitting up the companies it targeted to sell off the unprofitable parts—whatever it took.

The firm was on the prowl in its San Diego offices, pouring over the finances of companies it thought were in need of a kick, when it came upon Timken Steel in the city of Canton, Ohio. It started buying Timken stock, enough to secure a knock on Timken's door in 2013.

The company, founded in 1901 by Henry Timken, was a steel bearing business. The family had an unbroken chain of command; when approached, Henry Timken's great-great-grandson Ward Timken Jr. was in charge.

Relational wanted Timken to break up—split into two companies to "unlock value" (and potentially cleave its relation to the community and leave the two smaller companies vulnerable to outside takeover attempts). After some vigorous fighting, Timken lost and Relational won. As a publicly traded company, Timken had a fiduciary duty to "do what's best for shareholders," and Relational had the numbers. In time it got its share price. It knew little about the steel business, or Canton, and it never planned to learn.

Issues other than money, deep issues, are never addressed in these scenarios. The Timken family had a tradition of loyalty to their city, including high wages for its unionized steelworkers, ongoing donations to their local public schools, and the founding of Timken High School, as well as support of the Canton Museum of Art and the downtown arts district. Workers at the company and the city of Canton were given a dose of modern financial medicine when they learned that money for its own sake counts more than they do.

Pure greed, with its handmaid fear, motivated the Timken break-up. You would never detect the hostilities by going to Timken's shining portal of a website. Meanwhile, Timken Steel's stock price is down almost 60 percent since Relational "unlocked" its value, from a high of $49 in August 2014 to a low of $6.41 in February 2016, with a climb up to $15.51 as of February 2, 2018. The downturn isn't Relational's problem, of course. It's gone.

Timken's story is hardly unusual. There are hundreds of Timkens, hundreds of companies, giant and small alike, that are valued only as data points in an information stream.

Private equity firm Greenlight Capital, for example, pressured General Motors to split its common stock into two classes in an effort to increase GM's market capitalization by a projected $38 billion. One class of stock would pay dividends, the other would give its holders all of the additional earnings. GM said such a move could destroy the company's investment-grade credit rating. Greenlight wanted a fight, and it got one. On June 7, 2016, the shareholders voted overwhelmingly (91%) against Greenlight.

European companies, after fighting this practice for years, are starting to get used to it. A company may need a push or a redo now and then, but like bankruptcy, voracious activism is too often used like an ordinary business practice, when it isn't that at all.

What Happened to Our Markets?

Not that long ago, brokers would bring new companies to the market, investors would buy shares, and the brokers would get a fee for marketing the company. The brokers expected the company to grow and be successful, or they would not have marketed it. The companies, the investors, and the brokers felt they had a fair deal. Classic capitalism.

The stock exchanges are now mere shadows of their former selves. They no longer function as places for new companies to market shares. There are no human middlemen connecting buyers and sellers. The New York Stock Exchange's owner, Intercontinental Exchange, is now backed by Goldman Sachs, Morgan Stanley, British Petroleum, Total, Shell, Deutsche Bank, and Société Générale, which run their own exchanges.

The investment banks and private equity firms aren't interested in helping companies go public and grow. Their exchanges are information processors. Their programmers create algorithms to wage war at the speed of light with competitors' algorithms. Short-term gain is the only game in town—it's rough out there. Take the money and run.

The exchanges and the programming wizards they depend on to stay competitive operate on a plane unattached to day-to-day life. It is not real to them that there are human beings on the other sides of the trades. The exchanges are removed (literally, the more hidden the building, the better) from the people, companies, economies, and cultural roots that form the market's playing field. This situation as it has developed is not part and parcel of capitalism. It’s some strange thing that can cause strangulations. It’s anti-capitalism.

The Science

of Money

There is a strong storyline in modern finance, which is: processes like the break-up of Timken Steel or the movement of American manufacturing overseas or the demise of the human trader and rise of algorithmic models are simply inevitable. Traditional ways of doing anything are simply no longer feasible—they're ridiculously and hopelessly old-fashioned.

In this view, a product is less important than its profitability. Some widely important products, like vaccines, are consistently underproduced (and doled out by state public health agencies) because they're just not profitable enough. (See also this Wall Street Journal Report on the lack of cheap drugs.)

Profit for whom? The pension managers, 401k and IRA holders, mutual funds, corporations, and individual investors whose money is traded?

Not as much as you think. Investment banks, hedge funds, and private equity firms enjoy a public persona as savvy investors and risk managers. But in an environment in which they own their own high frequency trading exchange or pay great sums to be co-located at one, money is often not made from smart investing.

Profit can actually be guaranteed. Arbitrage is the name given to the process that helps markets go into equilibrium across the globe. It' an important event for price stability in all kinds of markets. But it can be exploited. For example, an exchange can buy Company A's stock at a lower price in one market (e.g., showing $12 on a New York exchange), and also sell it instantaneously where it's priced higher (e.g., showing $12.10 in London). The trades continue until the prices match. By the time the price equilibrates, the exchanges have taken the gains with nothing left for investors whose orders come a second or two later.

It's not just the price difference capture. In a high frequency system of continuous trading, every split-second trade generates a fee. Risk-free trades + constant fees = investor loss.

This can be a dangerous mix. Not just because different algorithms can get out of sync and cause large and small flash crashes, but because this whole "ownership" of the market engenders the intimidating assumption that there is nothing we can do to puncture the move into the great divide between those at the top and the rest of the world.

Illustration © Giacomo Marchesi.

The aura of the so-called "science" of financial engineering (along with blurry corporate geographic boundaries) provides a cushion of remove for the money elite, whose real business is a game of winning or losing. Collateral damage along the way—people losing their retirement investments, their jobs, homes, or sense of purpose in life—is too bad, but sorry, you can't point a finger at anyone personally. This is the genius of this system.

There's another belief at work, that the winners in this winner-take-all world are simply heaping the rewards of being smart. We are slaves to this idea—smart people with smart money and smart technology.

Tech and finance are the only industries (perhaps government too these days) whose top practitioners regularly and openly congratulate themselves and each other for being smart, which here means has the fastest computers/makes the most money. What would we think of Shakespeare, Mozart, Lincoln, or Bohr, for just a few examples, if they were known to have constantly referred to themselves as "really smart" and therefore deserving the most money?

This narrow view of intelligence and proprietary usurpation of language make for a slippery slope. In fact, financial engineering is not at all scientific. Science seeks truth for its own sake. Algorithmic models are logical tools, not scientific ones. Logic isn't necessarily intelligent, it's just logical. (As history has shown, madmen and tyrants can also dream up logical systems to accomplish their goals.)

When I first started reading financial news, I had to read certain articles out loud, simply to listen to the language and let the real meaning sink in. It took practice. The argot of "smart" money—derivative, dark pool, bad bank, shadow banking, structured product, circuit breaker, poison pill, quote stuffing, junk, front running, flashing, co-location, low latency, invisible, black box, etc.—serves just as well to obscure as it does to describe. The argot keeps the dumb reader and the dumb money in their dumb place. But as a language for greed, fear, and the slippery slope, it works nicely.

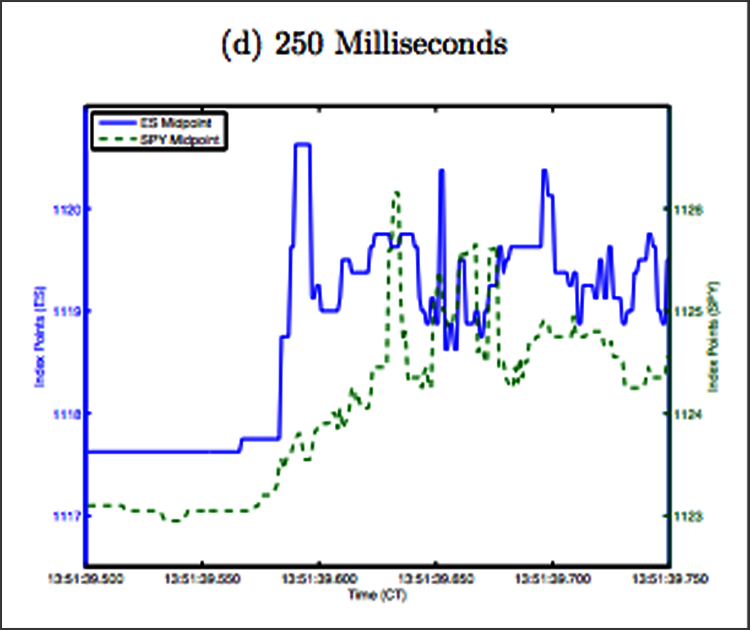

The timeline on the graph below, from beginning to end, covers 250 milliseconds. This stretched-out .25-second space-time interval, its peaks and vales, are what the algorithms exploit to get their price advantages. This is where the action is.

Used by permission.

This graph, from a real day in 2011, shows the price movements of the two largest financial instruments that track the S&P 500 index—the SPDR S&P 500 exchange traded fund (SPY, blue line) and the S&P 500 E-mini futures contract (ES, green line), within the 250 milliseconds. On a one-minute graph the paths would look much the same, but here the miniscule price breakdowns shine loud and clear.

The individual investor making trades on his computer at home will never compete in this arena, but his losses will likely be small. It’s the pension funds, mutual funds, and retirement accounts that take the brunt of it.

Another thing—most of the money in the world now consists of zeroes and ones in binary code. Only about 20 percent is in coins and bills. Let's hope that the banks to whom we entrust our zeroes and ones are doing a good job of protecting them. Bugs, hacking, and theft happen.

11110100001001000000

—$1 million, to your computer.

What Lies Beneath

There's no doubt, the accumulation of vast amounts of money is addictive. No one type of person (maybe the Mother Teresas of the world) is immune, as far as I know. I could be wrong. Many things have to be present in an environment where addiction becomes the modus operandi—and thus a serious problem.

Long ago, the divide between the elite and the rest of the word actually insulated us from the former's activities. There is too much pressure now on all levels of middle and working class people, many of whom don't understand that they've been assigned a role in somebody else's game and are expected to play their part.

Now, our financial system shamelessly scavenges Jane Doe's checking account in a way that would confound her if she knew the extent of it. It has found a way into her pockets, which are not deep.

This is not normal. The guys at the top know it, but they suffer from the same illusion as Ms. Doe, that somehow things will work out for her. At some point, they won’t.

How did we get here? Did it start with the late 1990s stock bubble and bust, when the soon-to-retire saw their nest egg halved? Was it the banks, who with the government's blessing gave out no-job/no-downpayment mortgages like candy? The loan offices who saturated our mail boxes with pre-approved credit cards and home equity loans so we could take vacations? The government and higher education spreading student debt like the sorcerer's apprentice?

Not even pensions, which people stayed in jobs for 30 years to secure, are sacred. Corporations are unceremoniously dumping this responsibility onto the Pension Benefit Guarantee Company (yes, taxpayers), which never bargained for such a burden.

What lies beneath is fear. When you have tons of money, you need more money. You can't lose it. You must protect it. You can't see straight. Not everyone, but the needy ones. The ones who, when the financial world fell apart in 2009, were terrified of losing their money, and soothed only when the government bailed them out. If their failures were in the too-big-to-fail arena, if the banks are our financial system, why aren't they run like utilities? Jane Doe didn't get the same favor; eight years after the crisis her savings account gives her a .25 percent interest rate.

Greed, fear, obsession—not a recipe for long-term growth.

Neither is ignorance. I was reading a story a while ago about a worker from the Rust Belt who lost his full-time, $29 per hour job with its heap of benefits. He said he and his wife will have to give up their yearly vacation, which was usually a couple of weeks in a place like Aruba. Why were they taking vacations every year on $29 per hour? Maybe it's just me, but they should have been saving that money. I’m not advocating unhappiness. Maybe they could have vacationed every other year, or closer to home. We all need to close our ignorance gap.

Tech Guys

Erik Hunsader is founder and CEO of the software firm Nanex. He is a critic of the "rampant fraud" let loose by high frequency trading algorithms. In a 2013 documentary made by VPRO Backlight, the Dutch broadcaster, he said of the relation between HFT and the economy:

High-frequency trading has nothing to do with economics. It has everything to do with understanding how networks operate, how they fail, how to make them fail, how to make them fail in your advantage, how to make them fail in your advantage without being detected. ... One nanosecond faster is all you need to be [1 nanosecond = 0.000001 milliseconds]. (Wall Street Code, Hunsader @ 18:28 min. ff)

If it has nothing to do with economics, why is it the biggest game in the market?

Thomas Peterffy, a Hungarian-American immigrant who founded the online brokerage Interactive Brokers Group, noted in the same video that pensioners and large investor groups:

[D]o not understand that it is their money that the banks are taking from them and reporting as profits. If they understood, they would do something about it, but the problem is that they do not understand. (Wall Street Code, Peterffy @ 31:30 min)

In the same documentary, David Lauer, a former high frequency trader at a well-known hedge fund, gives a vivid description of the trading stations at the time of the 2010 flash crash. There was no market at all, he said, for several seconds; the screen was blank (and we know that in this world, a few seconds is forever, could drive you down to zero). "I lost faith in capitalism," he said, "or at least what we had built to be capitalism. ... I lost trust":

My friend has a PhD in climate science from Harvard, who was working there. There was a PhD in bioinformatics sitting next to me. A semiconductor designer on the other side. Sitting behind me was a masters in math from MIT. And these people are taking their huge brain power and devoting it to making pennies in a high frequency trading system. And I couldn't really, I couldn't justify that anymore. Because these, they should have been doing, they should have been curing cancer, or global warming, and here they are, they're making a fortune, and, and, were we making the markets a better place? Were we increasing efficiency or stability? I mean, that day showed me that we weren't. (Wall Street Code, Lauer @ 37:19 min. ff. Emphasis mine.)

Haim Bodek of Decimus Capital Markets said about fear on Wall Street:

I don't think people realize how fear-oriented it is. There's all these people on Wall Street who think they are so strong willed, and so deserving. But if you look at a day to day, you know, the day to day life is constant fear. You're, you're afraid, if, you know, you're playing the wrong music when you drive into the parking lot. ... There's so much fear, the hierarchy has such a pecking order, especially in the investment banking world. ... The idea of being in financial distress, the idea of having your reputation sullied, being rejected, it's their worst nightmare. (Wall Street Code, Haim Bodek, "the algo arms dealer" @ 48:23 min. ff)

The CNN Money video below with David Lauer is only five minutes long. It's worth listening to. He describes quote stuffing as a form of hacking, a denial-of-service.

Parallel Time-Space Universes

Sometimes in my car I am behind a very slow driver, for example someone going 23 miles per hour in a 30-mph zone. With no one in front of me, I would probably drive within a seven-mile or so range, between 30 and 37 mph. But behind a driver whose unnecessary slowness causes me consternation, I never tailgate or pressure. I go even slower. Suddenly, the guy in front goes faster. Then, like in the Irish blessing, the road rises up to meet me.

I thought of this when I read about IEX Exchange founder Brad Katsuyama's response to high frequency trading. He went slower. He wanted IEX's road to rise up to meet investors. IEX delays each trade by 350 millionths of a second. It does not pay brokers for volume orders. It doesn't charge huge sums, or any sum, for data feeds, faster speeds, or co-location. There are no disagreements as to whose system is physically closest to the exchange's machinery. (A firm with a 500-foot cable would otherwise get a one-half of one-millionth of a second advantage over a firm with a 1000-foot cable.)

In an earlier video in the VPRO Backlight series, the historian George Dyson noted that once only nuclear weapons designers and physicists cared about what happened in frequencies of a billionth of a second, but "now it concerns all of us because it’s gone into this financial world that represents all our wealth" (Dyson, Inside the Black Box @ 18:10 min. ff).

Listen to Dyson:

[I]n a digital universe there is no time. Time as we know it does not exist. The computer is not operating on time. It operates on sequence. Something happens, then the next thing happens, then the next thing happens. It follows the instructions it’s given. We impose our clock on their system. So this other world exists now in our world that is not tied to our form of time at all. (Money & Speed: Inside the Black Box, Dyson @ 39:43 min. ff. Emphasis mine.)

You don't want it to be that the S&P is 1000 points here and 1020 points there. It's the same index. It should just be 1000. ... If you have the exact same instrument priced differently in two places at the same time, that's free money. ... It's making money out of the malfunction of the system. (From the same discussion.)

The traders in this NPRO documentary have said (see 44:00 min. ff) that the markets, unlike airlines, don’t learn from their mistakes. They admit that they cannot predict how HFT algorithms will change from one market crash to the next, as the market has no air traffic controller. The technology and know-how to get one is so expensive that governments are not likely to invest in it. The programmers want to be extremely well-paid. Humans are good at designing the computers, they said, but not as good at operating them. Computers just do what they’re told. As algorithms evolve, the exchanges just see whether they work or not. That's it.

Four of the programming participants in this video admitted to not having one cent in the United States stock market. To make 5 percent in year, they said, you’re risking half your money.

Parallel universes. One timeless, one full of the minutes and hours of our lives (what the physicists call the "arrow of time"). The two are like water and oil, insoluble. (Remember learning in math class that parallel lines don't intersect except in infinity? We don't live there.) It's a stretch to believe that Jane Doe will adapt, because no one has fully adapted, not even the moneyed elite.

High frequency trading isn't going away; it’s more common than ever. Those who want to stay on top will be vigilant. They’ll come up with new and different routes to riches when the old ones no longer work for them. They're now seeking better software, software that can interpret data as it comes in, not simply collect it and trade it at the speed of light. WorldQuant LLC has five office in the United States, and fifteen in other parts of the world. The programmers will be busier than ever and will probably ruin their eyes in the process.

How do insoluble universes interface? It’s not just the money. The darker side of the technological revolution has loosened for some elites the cultural connections to our country and its government. As with other questions on the use of technology, this is a human issue, not a digital one.

We must be careful. A psychological serfdom could lead to the real thing. Nancy Isenberg’s 2016 book, White Trash: The 400-Year Untold History of Class in America, was an eye-opener, not just about the people and history she discusses. I hope that the post-World War II decades of prosperity were not an anomaly, in the long run. We all need a dose of Taleb's antifragility, the wherewithal for self-protection, both mentally and financially. There should be as much time and money dedicated to this as to power-making, but who will be our advisors?

Insecurities at the top have led to some bizarre actions. I read that in the midst of the recession some banks were taking out insurance policies on their employees, to collect on when an employee dies. This bit of news left me with a sick feeling. Do the employees know that their banks have dollar amounts on their heads?

Then there is the practice of taking out insurance policies on unrelated elderly people whom you do not even know. You pay the monthly premiums, and then cash in when the insured elderly dies. The investor wins if the insured dies nice and early. Businesses have also popped up to help the already-insured elderly sell their policies to unrelated investors for a lump sum far less than the value of the original policy, which has led to court battles with families after the insureds' death. It's true elder abuse.

These behaviors are the greedy & fearful kind. If the world’s top one-tenth of one percent do wring the globe dry, however, they'll have nothing left to play with. No customers, no pensions or IRAs, no small but numerous investment accounts from which to scrape a profit.

The race may be to the swift, but we're not all in the same race.

References & Works Cited

"Algorithmic Trading and NeverLoss Trading," NeverLoss Trading.

"Arbitrage," Investopedia (2016).

Eric Budish, Peter Cramton & John Shim, "The High-Frequency Trading Arms Race: Frequent Batch Auctions as a Market Design Response," The Quarterly Journal of Economics (Nov. 2015).

Tressie McMillan Cottom, Lower Ed: The Troubling Rise of For-Profit Colleges in the New Economy (The New Press, 2017).

Nancy Isenberg, White Trash: The 400-Year Untold History of Class in America (Viking, 2016).

John Lanchester, How to Speak Money (W.W. Norton & Co., Inc. 2014).

Alec Liu, "What Led Whistle-Blower Haim Bodek to Expose the Biggest Scam on Wall Street?" Vice (Dec.19, 2014).

Ferdinand Lundberg, The Rich and the Superrich (General Publishing Co., Ltd., 1968, 1988).

Mariana Mazzucato & Michael Jacobs, eds., Rethinking Capitalism (John Wiley & Sons, 2016).

Money & Speed: Inside the Black Box, VPRO Backlight Documentary (Dec. 13, 2012).

Ben Popper, "The Startup Trying to Clean Up Wall Street Just Became an Official Stock Exchange," The Verge (June 17, 2016).

Nelson D. Schwartz, How Wall Street Bent Steel, The New York Times, Dec. 6, 2014.

Student Loan Hero (March 10, 2017).

Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder (Random House, 2011).

Henry David Thoreau, Walden, Ch.18.

The Wall Street Code, VPRO Backlight Documentary (Nov. 4, 2013).

Jason Zweig, The Devil's Financial Dictionary (Public Affairs, 2015).

Comments? Please send your responses

on the site's Contact page.Thank you!